Long Term Capital Gains Tax Worksheet 2020

Meaning of Capital Asset Capital asset is defined to include. Its the gain you make thats taxed not the.

Capital Gains Capital Gain Accounting Education Accounting Basics

The most common income tax situations are explained in this guide.

Long term capital gains tax worksheet 2020. View Forms Money Qualified Dividends Capital Gain Tax Worksheet. The 2020 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37. Distributions of net realized short-term capital gains arent treated as capital gains.

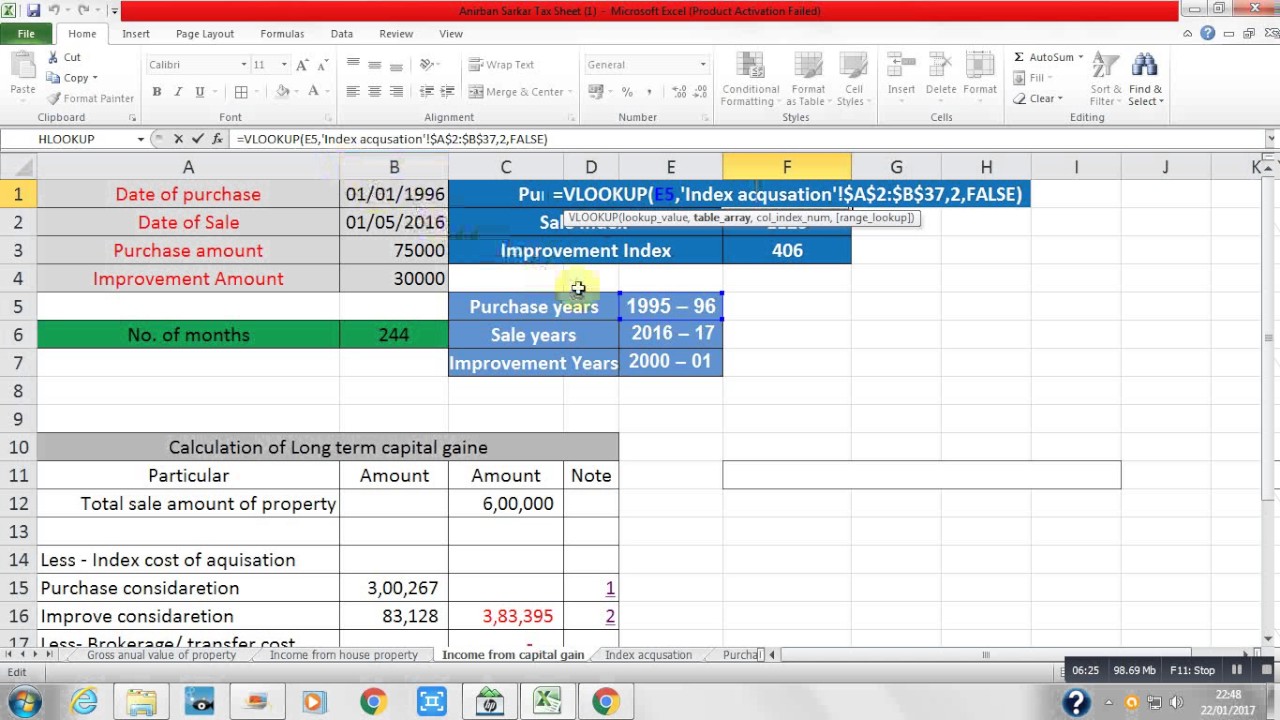

There is option to include cost of repairsimprovement that you might have incurred during the holding period. Short-term investments held for one year or less are taxed at your ordinary income tax rate. This chart shows the long-term capital gains tax rates for 2020.

How the 0 Rate Works The 0 tax rate on capital gains applies to married taxpayers who file joint returns with taxable incomes up to 80000 and to single tax filers with taxable incomes up to 40000 as of 2020. _____ Disposal of QOF investment. 2020 Long-Term Capital Gains Tax Rates.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Solved Smith Wife Married File Joint Tax. In this part you can gain knowledge about the provisions relating to tax on Long Term Capital Gains.

Up to 40000. The amount you pay in federal capital gains taxes is based on. Long Term Capital Gains Tax Rates Motley Fool.

Subtract line 12 from line 9. These distributions are paid by a mutual fund or other regulated investment company or real estate investment trust from its net realized long-term capital gains. 13 Zeilen Capital Gains and Losses and Built-in Gains 2020 12222020 Inst 1120-S Schedule D.

It calculates both Long Term and Short Term capital gains and associated taxes. Thats why some very rich Americans dont pay as much in taxes as you might expect. Long-term capital loss carryover for 2020.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. Meanwhile for short-term capital gains the tax brackets for ordinary income taxes apply. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

52 Zeilen The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it foradjusting for commissions or fees. Tax Information Ready Early Avoid Surprises.

Instead they are included on Form 1099-DIV as ordinary divi-dends. Capital gain or capital loss worksheet this worksheet helps you calculate a capital gain for each cgt asset or any other cgt event 1 using the indexation method 2 the discount. Stimulus Tax Rules Year Questions.

Tax rates for short-term gains in 2020 are. Ultimate 2020 Tax Planning Guide Motley Fool. A brief idea on Capital gain taxes on MutualFunds.

Lets take a closer look at the details for. You need to feed your property sale purchase date along with values. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as.

Schedule Report Capital Gains Losses. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. Investments held long-term more than one year will be taxed at a.

2020 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. 10 12 22 24 32 35 and 37. How long you own a rental property and your taxable income will determine your capital gains tax rate.

Use this guide to get information on capital gains or capital losses in 2020. For gains between 80000 and 496600 the rate is 15 and for long term capital gains over 496600 the rate is 20. Even taxpayers in the top income tax bracket pay long-term capital gains rates that are nearly half of their income tax rates.

August 3 2021 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index. The long-term capital gains tax rate is 0 15. If more than zero also enter this amount on Schedule D line 14.

Depending on your income level your capital gain will be taxed federally at either 0 15 or 20. If you disposed of any investment in a QOF during the tax year check the box on page 1 of Schedule D and see the Instructions for Form 8949 for additional reporting requirements. The DownloadPrint Return PDF link for 2020 only pops up the file download with the only option and the worksheets are not included.

You generally have a capital gain or loss whenever you sell or are considered to have sold capital property. The lesser of lines 25 or 26 flows to line 27. A Any kind of property held by an assessee whether or not.

If zero or less enter -0-. The term Capital property is defined in the Definitions. Where is the Long-Term Capital Gain tax calculated and separated from Taxable Income.

Meaning of Capital Gains Profits or gains arising from transfer of a capital asset are called Capital Gains and are charged to tax under the head Capital Gains. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0. How to Figure Long-Term Capital Gains Tax.

2020 Quarter 2 Goal Review Optimism Over Cynicism Educator Fi Goals Review Goals Goal Update

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Mutual Fund Long Term Investment Calculator

Mutual Fund Long Term Investment Calculator

What Is Schedule D Here Is An Overview Of The Schedule

Tax Season 2021 What You Must Know About New Reporting Rules Mystockoptions Com

Cost Inflation Index From Fy 1980 81 To Fy 2013 14 Index Income Tax Financial

2021 W4 Form How To Fill Out A W4 What You Need To Know Need To Know W4 Tax Form Going Crazy

5 Ways To Invest In Your Tfsa In 2020 Tax Free Savings Free Savings Account Finance Investing

Appreciation And Depreciation Worksheet Printable Worksheets Are A Precious Classroom Too In 2021 Budget Spreadsheet Budget Spreadsheet Template Spreadsheet Template

How To Calculate Long Term Capital Gain Tax On Equity Shares And Mutual Fund From 1st April 2018 Capital Gains Tax Capital Gain Mutuals Funds

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital

How To Calculate Capital Gains Tax On Property How To Save Capital Gain Tax Capital Gains Tax Capital Gain Tax

Taxes Money Financial Tips Corporations Are Legal Entities They Can Own Assets And Act What Does Th Financial Tips Money Financial Finance Saving

Difference Between Investing And Financing Activities With Table Dbms Different Molecular

Retirement Budget Worksheet Excel Worksheets Are Definitely The Spine To Scholars Learnin In 2021 Budget Planner Worksheet Budgeting Worksheets Weekly Budget Planner

How To Calculate Income From Capital Gain Datedif B3 New Formula 2021 By Using Excel Formula Youtube

Posting Komentar untuk "Long Term Capital Gains Tax Worksheet 2020"