Capital Gains Tax Rate Worksheet

Capital Gains Tax civil partners and spouses Self Assessment helpsheet HS281 6. The tax rate you pay on your capital gains depends in part on how long you hold the asset before selling.

Form 1041 Schedule D Capital Gains And Losses

But there is an option for deferring capital gains taxes from the sale of an investment property by reinvesting the proceeds.

Capital gains tax rate worksheet. The positive gain here is equal to the selling price minus the buy price minus the buy commission minus the sale commission. In 2020 the capital gains tax rates are either 0. Short-term capital gains are gains you make from selling assets that you hold for one year or less.

For example your house furni-. Otherwise complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and 1040-SR line 16 or in the instructions for. There are short-term capital gains and long-term capital gains and each is taxed at different rates.

Remember this isnt for the tax return you file in 2021 but rather any gains you incur from january 1 2021 to december 31 2021. Tax Due at Maximum Capital Gains Rate - 25 rate gain x 25 line 9 x 25 12 15 rate. Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis Purchase price 1 Improvements added after purchase 2 Deferred gain from.

That applies to both long- and short-term capital gains. How much these gains are taxed depends a lot on how long you held the asset before selling. If you received capital gain distribu-tions as a nominee.

This means youll pay 30 in Capital Gains Tax. 1400 1200 25 25 150. The web address at box 9 of the notes for information on Capital Gains Tax for.

Form 8949 Part II includes a section 1202 exclusion from the eligible gain on QSB stock or. 1 hours ago Capital Gain Worksheet Sale of Depreciable Real Estate Calculation of Adjusted Basis Purchase price 1 Improvements added after purchase 2 Deferred gain from previous 1031 exchange if any 3 Tax Due at Maximum Capital Gains Rate - 25 rate gain x 25 line 9 x 25. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax.

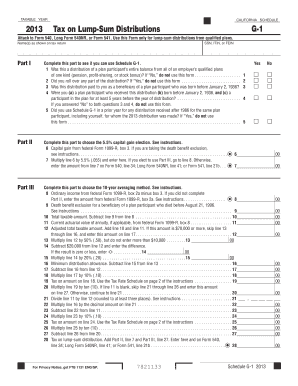

Temporary non-residents and Capital Gains Tax Self Assessment helpsheet HS278 6 April 2021. Now lets move on to a more complicated scenario. Capital Gains Tax Rate 2013 Worksheet.

28 Rate Gain Worksheet. Qualified Dividends and Capital Gain Tax WorksheetLine 11a. Capital Gains Tax Rate Worksheet.

The tax rate that applies to the recaptured amount is 25. Capital Asset Most property you own and use for per-sonal purposes or investment is a capital asset. Calculates a capital gain or capital loss for each separate capital gains tax CGT event.

Hes only paying a 159 rate on dividends and capital gains because with very little ordinary income some of his long term capital gain and dividend income can fit into the 0 long term capital gain tax rate bracket which in turn makes more room for income that would otherwise be taxed at the 20 bracket to fall into the 15 bracket. So in the example above if the person sold the building for 110000 then thered be total capital gains. You show the type of CGT asset or CGT event that resulted in the capital gain or capital loss and.

There is currently a bill that if passed would increase the capital gains tax in Hawaii to 11. Capital gain worksheet tax rate. Rate Gain Worksheet in these instruc-tions if you complete line 18 of Sched-ule D.

Before completing this worksheet complete Form 1040 through line 10. Includes short and long-term Federal and State Capital Gains Tax Rates for 2020 or 2021. The investor made a profit of 150 on this investment.

Keep for Your Records. Capital Gain Worksheet Qualified Intermediary for IRS. In 2020 the capital gains tax rates are either 0 15.

The Capital gain or capital loss worksheet PDF 143KB This link will download a file. Posts Related to 28 Capital Gains Tax Rate Worksheet. The Capital gains summary notes for 2017 have been updated for box 14.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. If the sum of short-term capital gains or losses plus long-term capital gains or losses is a gain the 28 Rate Gain Worksheet will be produced if either of the following is true. If a capital gain was made you calculate it using.

Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Hawaiis capital gains tax rate is 725.

Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4e or 4g even if you dont need to file Schedule D.

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

Long Term Capital Gain Tax Rate For 2018 19 Capital Gain Capital Gains Tax What Is Capital

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

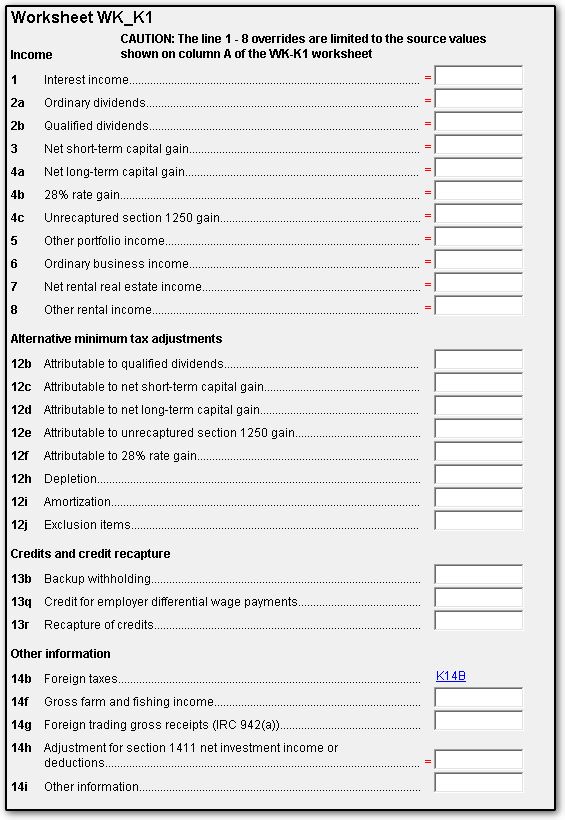

1041 Wkk1 Screen For Worksheet K1 K1

Capital Gains Tax Worksheet Promotiontablecovers

/486989097-56a938ab3df78cf772a4e54c.jpg)

Capital Gains Tax Worksheet Promotiontablecovers

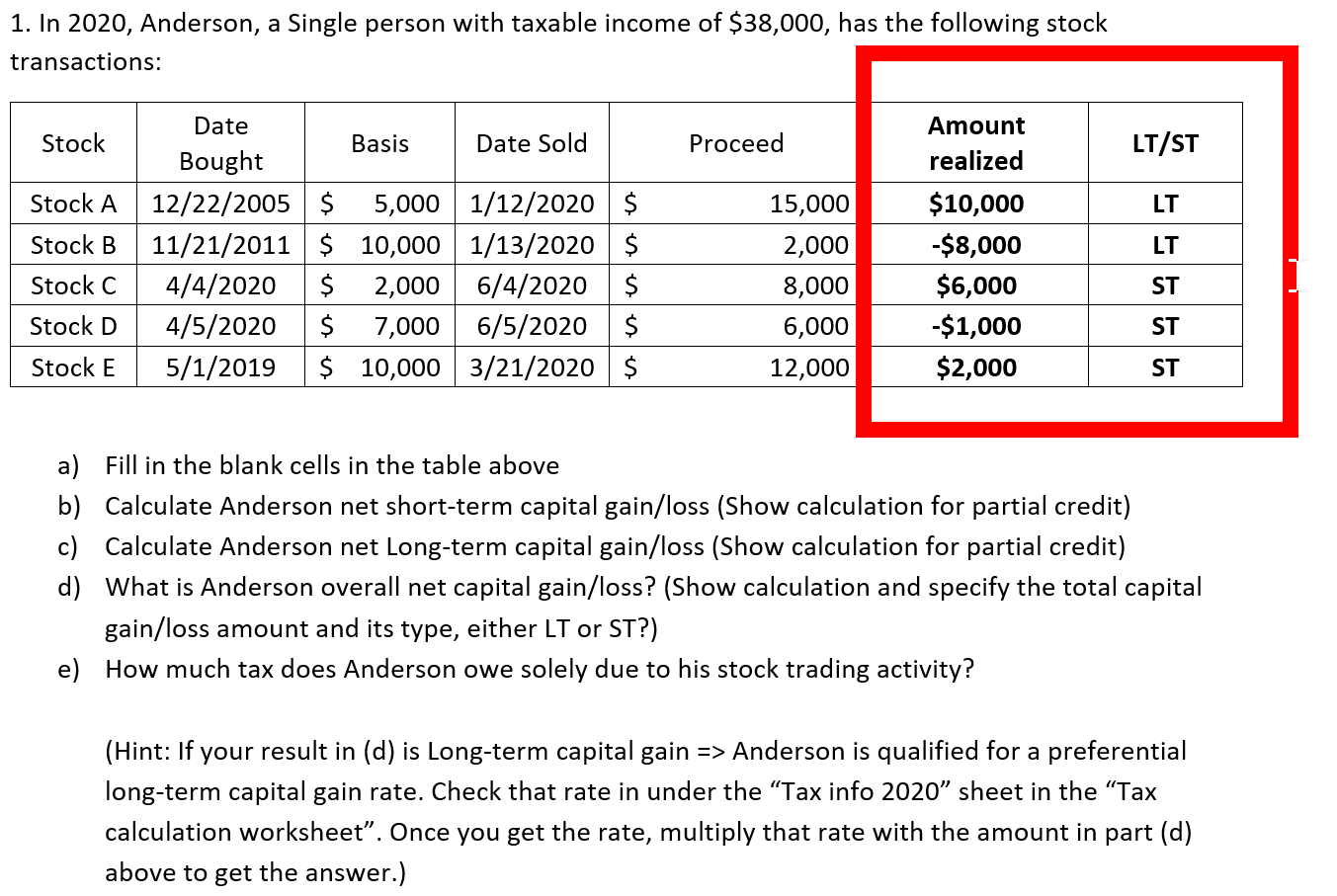

Please Help Me Answer This Tax Question As You Can Chegg Com

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

Capital Gains Tax Worksheet Promotiontablecovers

How To Report These On Schedule D Tax Return James Chegg Com

Posting Komentar untuk "Capital Gains Tax Rate Worksheet"